Non-Cash Gifts – Thanks to our relationship with the National Christian Foundation and NCF Tampa Bay, our ministry can receive non-cash charitable gifts into The Great Commission Partnerships Single Charity Fund.

Non-Cash Gifts – Thanks to our relationship with the National Christian Foundation and NCF Tampa Bay, our ministry can receive non-cash charitable gifts into The Great Commission Partnerships Single Charity Fund.

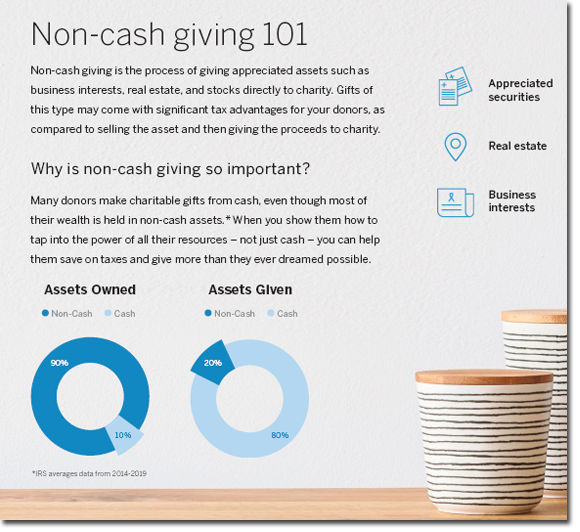

- Non-Cash Assets – as a broad category, you can think about giving from non-cash assets as a tax-advantaged strategy to take money you would likely have to pay for taxes, and give that money to a charitable organization like GCPN instead. Non-cash giving can come from Appreciated Securities (read more below); Real Estate; Business Interests; Personal Property; Restricted Securities; Loan Notes; Estate Gifts; Retirement Plans; and Life Insurance. Watch the NCF video (click above) and navigate to their Non-Cash Giving page here to learn more.

– - Appreciated Stock can be donated on a tax-favorable basis by giving shares to our Fund. Rather than selling the stock and having to pay capital gains tax, you can donate the stock to NCF, get a donation receipt for the face amount of the stock, and pay no capital gains tax. NCF receives the shares on our behalf, sells them for the face amount, and pays zero in capital gains tax, because they are a foundation. They then transfer the cash to our ministry. Everybody wins. The Kingdom grows.

–- To initiate a stock transfer like this, you need only:

- Speak to your investment manager / advisor and instruct them to transfer X-number of shares to the Great Commission Partnerships Single Charity Fund with NCF Tampa Bay (contact info below).

–

- Speak to your investment manager / advisor and instruct them to transfer X-number of shares to the Great Commission Partnerships Single Charity Fund with NCF Tampa Bay (contact info below).

- To initiate a stock transfer like this, you need only:

Charitable Gift Annuity – is a charitable solution for those who have a heart to give but desire a source of ongoing income. CGAs provide fixed payments for life at rates generally higher than CDs, and a portion of your payments are often tax-free. A CGA is a simple arrangement that involves a charitable gift and an annuity. You make the gift (part of which is tax deductible), and then you receive fixed annuity payments each year for the remainder of your life. If you wish, you can have the payments go to a family member or friend instead. NCF CGAs are backed by our unrestricted assets and are typically reinsured. This provides you greater certainty payments will last for your lifetime. But security and stability are not the only benefits you’ll experience with a CGA.

Charitable Gift Annuity – is a charitable solution for those who have a heart to give but desire a source of ongoing income. CGAs provide fixed payments for life at rates generally higher than CDs, and a portion of your payments are often tax-free. A CGA is a simple arrangement that involves a charitable gift and an annuity. You make the gift (part of which is tax deductible), and then you receive fixed annuity payments each year for the remainder of your life. If you wish, you can have the payments go to a family member or friend instead. NCF CGAs are backed by our unrestricted assets and are typically reinsured. This provides you greater certainty payments will last for your lifetime. But security and stability are not the only benefits you’ll experience with a CGA.

–

– Click here or on the thumbnail above to learn more.- To open an account like this, you need only contact NCF Tampa Bay:

NCF Tampa Bay

1901 Ulmerton Rd., STE 400 Clearwater, FL 33762

tampabay@ncfgiving.com

ncfgiving.com/tampabay/

813.567.1499 | 813.567.1504 (Fax)